I’m sorry. Recently, over a Sunday Bloody Mary at Molly Pitcher’s, a good friend told me that EdgyFin hooked him and then left him high and dry. Straight ghosted. Done caught the last train for the coast. He was holding back tears. Lots of tears. So many tears.

I’m sure most of you feel the same way. I can only imagine the frustration of checking your email over and over and over each day, only to see 50% off ammo deals at Cheaper Than Dirt and five receipts for each Uber ride.

My wife taught me to never use the word “but” after the words “I’m sorry.” So, I’m sorry, but due to finishing school and starting a new career, I’ve been lagging on my posts to you.

But yeah, “I’m thinking I’m back.”

Before we get to the uranium thesis update, let me fill you in on how much fun I’ve been having while you’ve been hitting the refresh button…

Wife, dogs, and I have been enjoying our new travel van and will be in a town near you shortly - save us a parking spot!

I caught this McNasty in Islamorada. We forgot the net. My friend jumped in the water and put this loverboy in a headlock. Pucker up!

You can’t resist it, it’s electric boogie woogie, woogie!

We are quickly approaching year 4 of my 3-5 year uranium investment thesis. And the uranium thesis is glowing! That’s a nuclear radiation joke. But seriously, it’s really picking up steam! That’s a nuclear fission joke. You’re welcome.

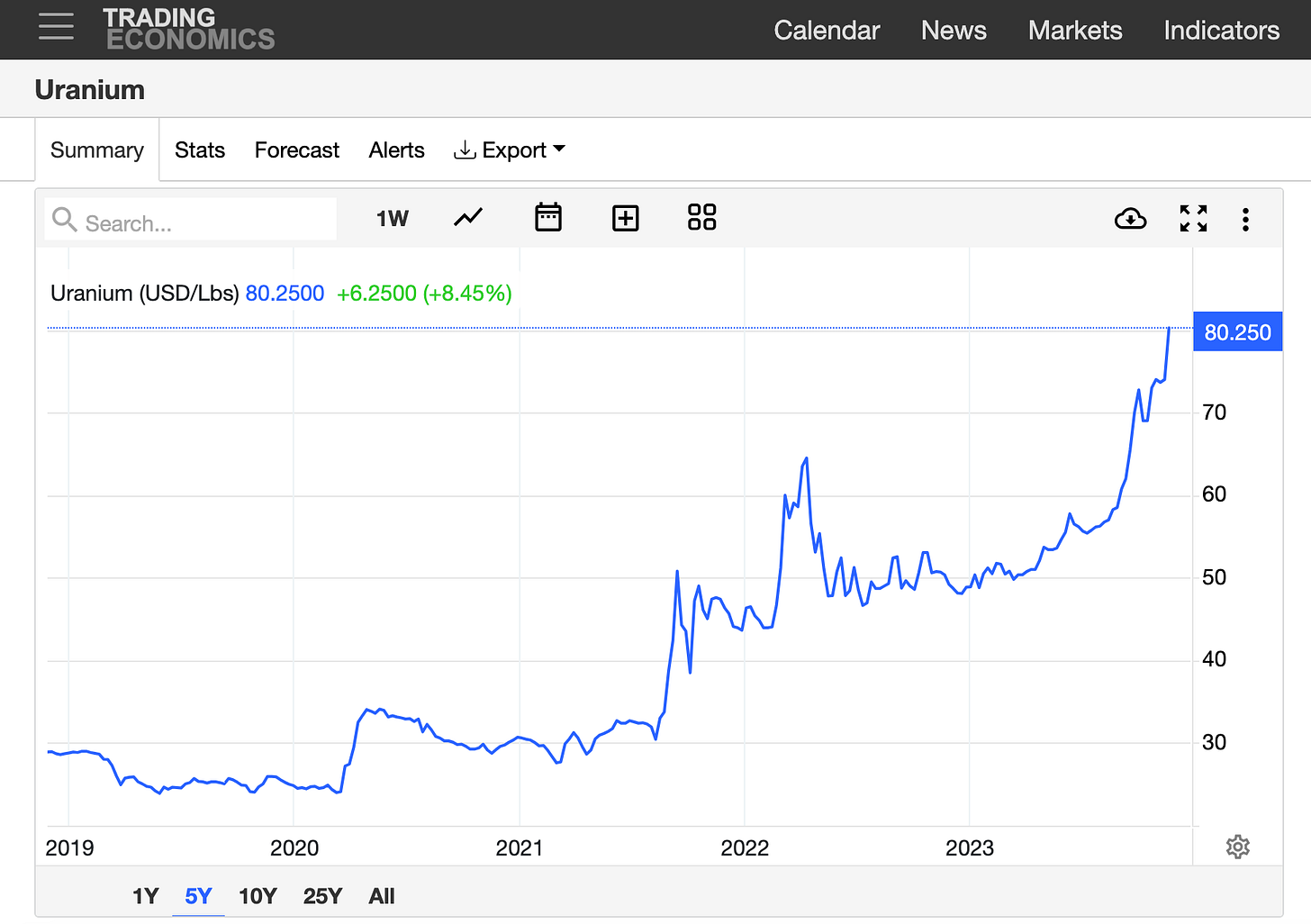

How’s the spot market?

In 2020, when I started averaging into my positions, the spot price of uranium was floating between $18/lb. and $25/lb. At the time, uranium producers were shutting down their mines - also known as placing them in care and maintenance status. Why? Because the all-in sustaining cost (AISC) to produce a pound of uranium, for a typical mining company, was closer to $60/lb. (it’s likely that inflation has pushed AISC to over $70/lb. today).

The utility companies (think GE) want to strike new long-term supply contracts at (or near) the spot price. It is uneconomical for the miners to enter long-term contracts at a price below their AISC. Shutting down production = constricting the supply and driving up the spot price.

The available spot supply has also been constricted by several new investment vehicles, like the Sprott Physical Uranium Trust. These investment vehicles are buying physical uranium and holding it, reducing the supply of uranium available in the spot market.

The producers and investment trusts are basically squeezing the utilities. And it’s working. The uranium spot price just hit a 15 year high at over $80/lb. Why will utilities pay higher contract prices? Unlike other fossil fuels, the commodity (U308) cost for nuclear power plants is only a small fraction of their total operating costs. The utility demand is inelastic, in other words, as the spot price rises the demand from utilities remains fairly constant.

The contracting cycle is just beginning. The utilities have been dragging their feet. When the spot price tops $100/lb., I expect utilities will start to panic. That panic, paired with inelastic demand, will favor the miners in contract negotiations.

Unexpected Tailwinds:

All investing is a guess at future outcomes. Research and considering multiple probabilities helps solidify conviction. However, there is always an element of luck (good or bad) that reveals itself from the dark unknown. My thesis was built on the current (2020) supply and demand numbers for existing nuclear power plants to remain operational. The following events and changing landscapes are tailwinds that strengthen the thesis - luck is on my side, so far (knock on wood, eeeek).

The Reliability of Renewable Technology

Despite the heavy ESG investments in renewables, like wind and solar, they are yet a consistent supply of baseload energy. The technology surrounding renewable energy storage and transportation is lagging. Turbine failures and replacement costs for wind are on the rise, and solar, while growing, is heavily dependent on rare earth elements currently controlled by China.

It has become clear that any realistic transition to net zero needs the reliable and consistent baseload energy that nuclear power provides. The narrative around nuclear energy is changing fast and nuclear energy is being considered as a qualifying ESG investment:

Energy Security is NOW National Security

The U.S., and the world, desperately need to reduce Russian and Chinese energy dependance (for obvious reasons). And they are trying to figure out how to accomplish this without sacrificing net zero commitments. During the second annual Japan - U.S. Energy Security Dialogue (October 2023), nuclear energy was an important part of the conversation.

There is a race for energy independence and security. China, India, and others countries are pushing new builds, creating a future uranium demand beyond the base case for my thesis.

Public Perception is Changing (is nuclear energy safe?)

Pew Research discovered the following:

My Favorite Tailwind

My edge is a 3-5 year time horizon allowing me to front run the Wall Street research analysts and big boy investment funds (they live and die by quarterly results and can’t enter positions as early as yours truly (see my previous posts about volatility, liquidity, and their obligation to clients). I’ve been waiting for them to show up to the party, and they are starting to arrive. From nei.org:

The Most Notable Risks:

Rising Interest Rates, Economic Tightening, and Market Decline

A stock market decline, which is likely, will pull uranium stocks down as investors exit positions to meet margin calls. However, this could be seen as a buying opportunity for those looking to build new position, but will extend my thesis time horizon and add more volatility to my already volatile positions.

Another Fukushima-Like Disaster

An accidental or deliberate nuclear event could derail the current narrative and public sentiment towards nuclear energy - causing investors to pull their positions.

New Technology

Though I see this as a low risk over the next year or two, it is still a risk. Any unexpected new technologies that propel another source of energy forward (like renewables) could lead to a change in sentiment and act as a shiny new opportunity that lures investors away from nuclear energy. But these advancements are going to be challenged by the development of new small modular reactors (SMRs).

The Portfolio is Responding Well

I’m seeing a lot more green than red these days. It is hard sitting on my hands, but it is also paying off. I plan to stay the course and hope to exit over the next 12-24 months. From my lips to God’s ears. Here are the portfolio returns to date:

Thanks for reading and remember to always swim with caution!

Disclaimer: EdgyFin is for educational purposes only and should not be considered investment advice. Please do your own due diligence and consult with a professional before you risk it for the biscuit!